Chevron Corporation (CVX), the sole Western supermajor permitted to pump Venezuelan oil, swung sharply in the markets this week. On Tuesday, Jan. 6, the stock dropped nearly 4.5%, its worst slide since April, just one day after a 5.1% surge tied to the unexpected U.S. capture of Venezuelan President Nicolás Maduro.

Chevron currently accounts for roughly 20% of Venezuela’s crude oil production, giving it the clearest strategic position to benefit from any rebuilding of the country’s long-dormant oil industry. Yet analysts increasingly caution that converting political momentum into sustained production growth may take far longer than markets anticipate.

The shape of a post-Maduro government and the scale of U.S. involvement continue to cloud timelines. Morningstar (MORN) analyst Andrew O’Conor noted that rebuilding Venezuela’s energy sector could take years, emphasizing that both the path forward and the time required remain highly speculative.

Still, Chevron continues to advance its interests. Reports indicate active discussions with the U.S. government to expand its operating license, potentially enabling higher crude exports to Chevron refineries and third-party buyers. In fact, Chevron is loading tankers at the fastest pace in seven months as the U.S. government tightens its grip on Venezuela’s crude flows.

Therefore, let us see if Venezuela-driven developments represent a durable growth catalyst or a fleeting narrative.

About Chevron Stock

Based in Houston, Texas, Chevron is a fully integrated energy leader. Its upstream business focuses on oil and natural gas exploration and production, while downstream operations refine crude into fuels, lubricants, petrochemicals, and additives.

Commanding a market cap of nearly $326.4 billion, Chevron’s shares have risen nearly 7.86% over the past year and 5.94% in the last six months. Recent geopolitical developments accelerated momentum, driving gains exceeding 9.17% in just one month.

From a valuation perspective, CVX stock trades at 22.63 times forward adjusted earnings and 1.74 times sales. Both metrics exceed industry averages, signaling a premium valuation.

Income investors continue to anchor the bull case. Chevron qualifies as a dividend aristocrat, extending dividend growth for 38 consecutive years. The company pays an annual dividend of $6.84 per share, yielding 4.41%. Its most recent dividend of $1.71 per share was paid on Dec. 10, 2025, for shareholders of record as of Nov. 18, 2025.

Chevron Surpasses Q3 Earnings

On Oct. 31, 2025, Chevron reported fiscal 2025 third-quarter results that topped Wall Street expectations despite a softer backdrop. Revenue declined 1.9% year-over-year (YOY) to $49.73 billion, yet exceeded forecasts of $49.01 billion. Adjusted EPS fell 26.3% to $1.85, still surpassing the Street’s $1.71 estimate.

Lower crude prices pressured earnings, while severance charges and transaction-related costs from the Hess acquisition added friction. Chevron partially offset these headwinds with stronger refined product margins, highlighting how its diversified upstream and downstream portfolio continues to absorb commodity volatility more effectively than a pure-play producer.

Even as profitability declined 21.1% YOY to $3.5 billion, Chevron delivered a clear operational milestone. Production reached a record 4.1 million barrels of crude oil per day, up 21% from last year, driven primarily by the Hess acquisition, which materially expanded the company’s production base.

Downstream performance strengthened the narrative. U.S. refining profits surged more than 300% to $638 million on higher product margins, while free cash flow jumped nearly 52.2% YOY to $7 billion.

Looking ahead, analysts anticipate continued near-term pressure. Consensus estimates call for Q4 fiscal 2025 EPS of $1.47, down 28.64% YOY. Full-year 2025 earnings are projected to decline 27.46% to $7.29, followed by a further 3.84% drop to $7.01 in fiscal 2026.

What Do Analysts Expect for Chevron Stock?

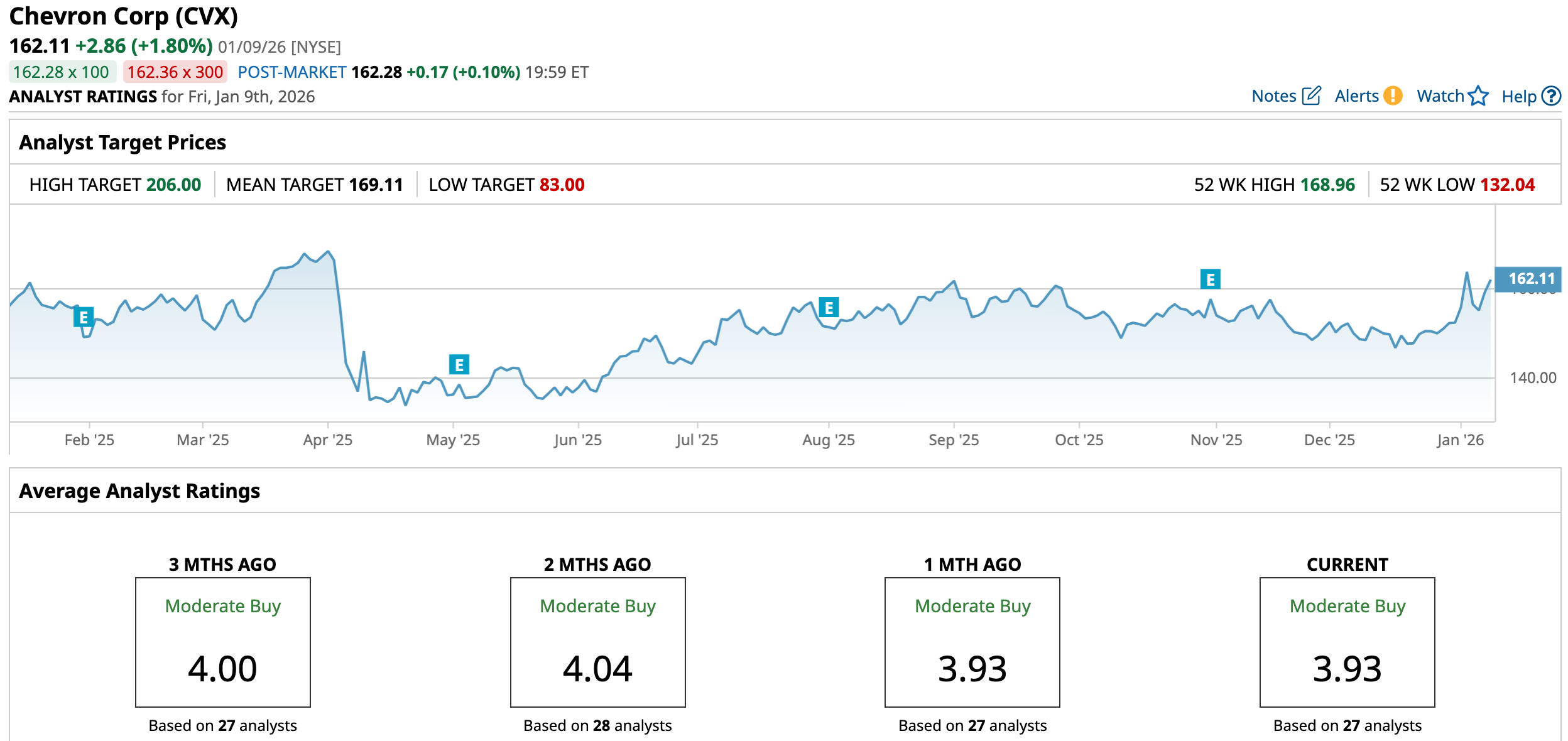

Analyst sentiment remains mixed but constructive. Bernstein has raised its price target to $172 from $170 while maintaining a “Market Perform” rating, citing near-term volatility but longer-term strength as Chevron enters 2026 with a measured and balanced oil market outlook.

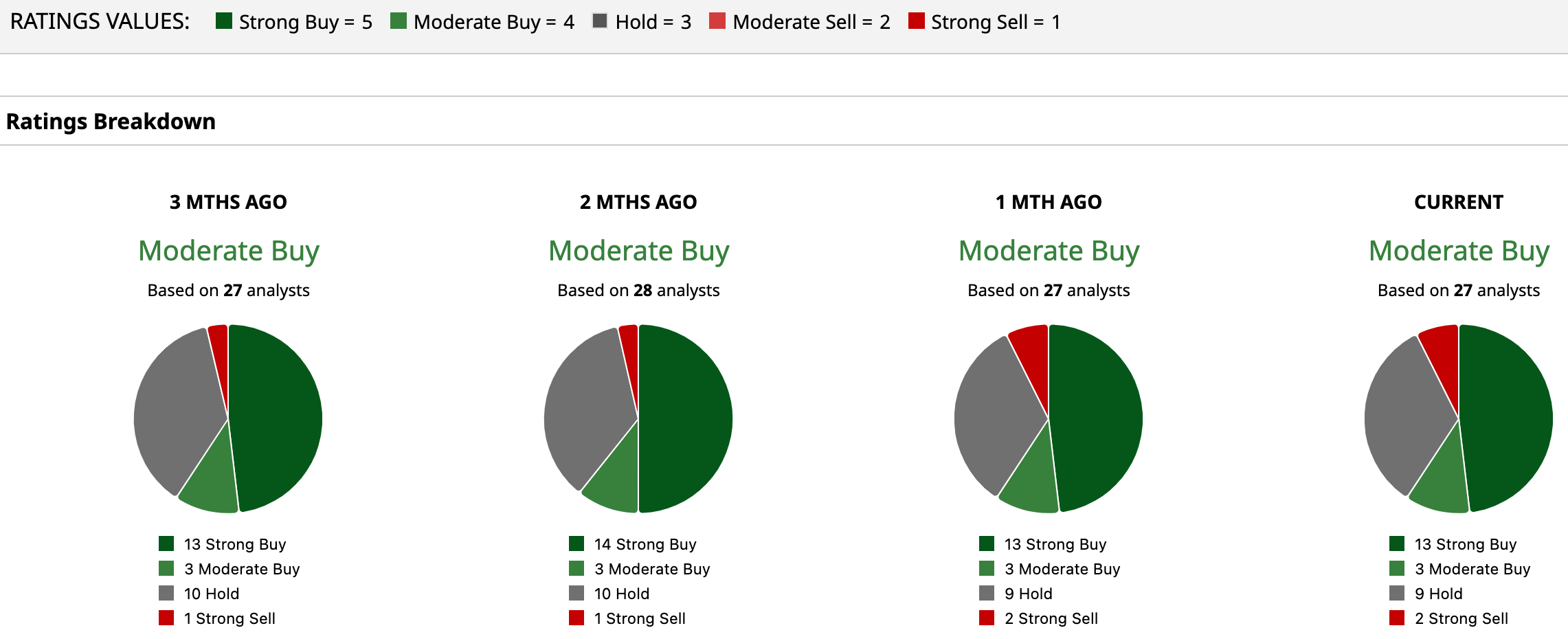

Overall, Wall Street has assigned CVX stock a “Moderate Buy” overall rating. Of 27 analysts, 13 recommend “Strong Buy,” three suggest “Moderate Buy,” nine advise “Hold,” and two flag “Strong Sell.”

CVX’s mean price target of $169.11 implies potential upside of 4.3%. Meanwhile, the Street-high target of $206 represents a gain of 27.1% from current levels, contingent on sustained production growth and favorable geopolitical developments aligning over time.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart