Axon Enterprise's (AXON) stock cratered 9.4% on Wednesday, marking the stock's worst single-day decline since mid-February, after the maker of Tasers and law enforcement software badly missed profit expectations despite posting record quarterly revenue. AXON stock has dropped another 8% during today's trading session.

In Q3 of 2025, Axon reported adjusted earnings per share of $1.17, below estimates of $1.52. The earnings miss was attributed to tariff pressures, which squeezed margins amid rising operating expenses. However, revenue rose 31% to $711 million, above estimates of $705 million. Notably, it was the seventh consecutive quarter where revenue growth exceeded 30%.

The earnings miss was also tied to margin compression in Axon's connected devices business, which includes Tasers and counter-drone equipment. Adjusted gross margins contracted 50 basis points to 62.7% as tariffs impacted the hardware-heavy segment that generated over $405 million in quarterly revenue.

Additionally, Axon swung to an operating loss of $2.2 million in Q3, compared to a profit of $24.1 million in the year-ago period, driven by aggressive hiring and stock-based compensation expenses as the company invests heavily in future growth.

It was Axon’s fourth straight quarter of operating losses despite surging top-line momentum. The company raised its full-year revenue guidance to $2.74 billion, while the midpoint of its adjusted EBITDA guidance for Q4 stood at $180 million, which is below the consensus estimate of $187 million.

The Bull Case for AXON Stock

The public safety technology leader continues to expand beyond its core Taser and body camera offerings into a comprehensive platform spanning drones, real-time operations, and artificial intelligence (AI) capabilities.

The company's software and services business remains the primary growth driver, surging 41% to $305 million with annual recurring revenue reaching $1.3 billion and a net revenue retention rate of 124%.

Connected devices revenue grew 24% to $405 million, driven by the adoption of Taser 10, body camera upgrades, and platform solutions, including counter-drone technology. The AI Era Plan, launched in October 2024, has already generated over $200 million in bookings this year, with management expecting AI to contribute more than 10% of U.S. state and local bookings for the full year.

The bundle includes Draft One automated report writing, which saves officers roughly 11 hours weekly, real-time translation capabilities, and Policy Chat, which provides instant access to department procedures. Year-to-date (YTD) bookings have accelerated more than 30% with management projecting a high 30% growth for the full year.

Axon made significant strategic moves to expand its ecosystem with the acquisitions of Prepared and the pending Carbyne acquisition, valued at $625 million. Together, these companies create what management calls Axon 911, providing AI-powered voice communication automation for emergency call centers alongside cloud-based infrastructure that replaces legacy on-premise systems.

The 911 platform integrates seamlessly with Fusus' real-time crime centers, body cameras, and drone capabilities to create an end-to-end connected platform, from the initial 911 call through incident response.

International business delivered two of the company's top ten deals in the quarter, including a nine-figure cloud contract in Europe, signaling accelerating adoption beyond traditional markets.

The corrections segment contributed two additional top-ten deals, with YTD bookings more than doubling. Management emphasized aggressive investment plans across research and development, sales capacity, and emerging categories, including vehicle intelligence, automated license plate readers, and the launch of the Mini enterprise body camera next year, targeting the retail and corporate security markets.

Is AXON Stock Still Overvalued Right Now?

Valued at a market cap of over $50 billion, AXON stock has returned more than 3,500% to shareholders over the past decade. Today, it trades 20% below all-time highs, allowing you to buy the dip.

Analysts tracking AXON stock forecast revenue to increase from $2.08 billion in 2024 to over $5 billion in 2029. During this period, its free cash flow is predicted to grow from $329.5 million to $1.22 billion by 2029.

Today, AXON trades at a forward FCF multiple of 69x, which is below the five-year average of 93.6x. If AXON stock trades at a lower multiple of 50x, it should return 20% within the next four years, which is a steady rather than spectacular result.

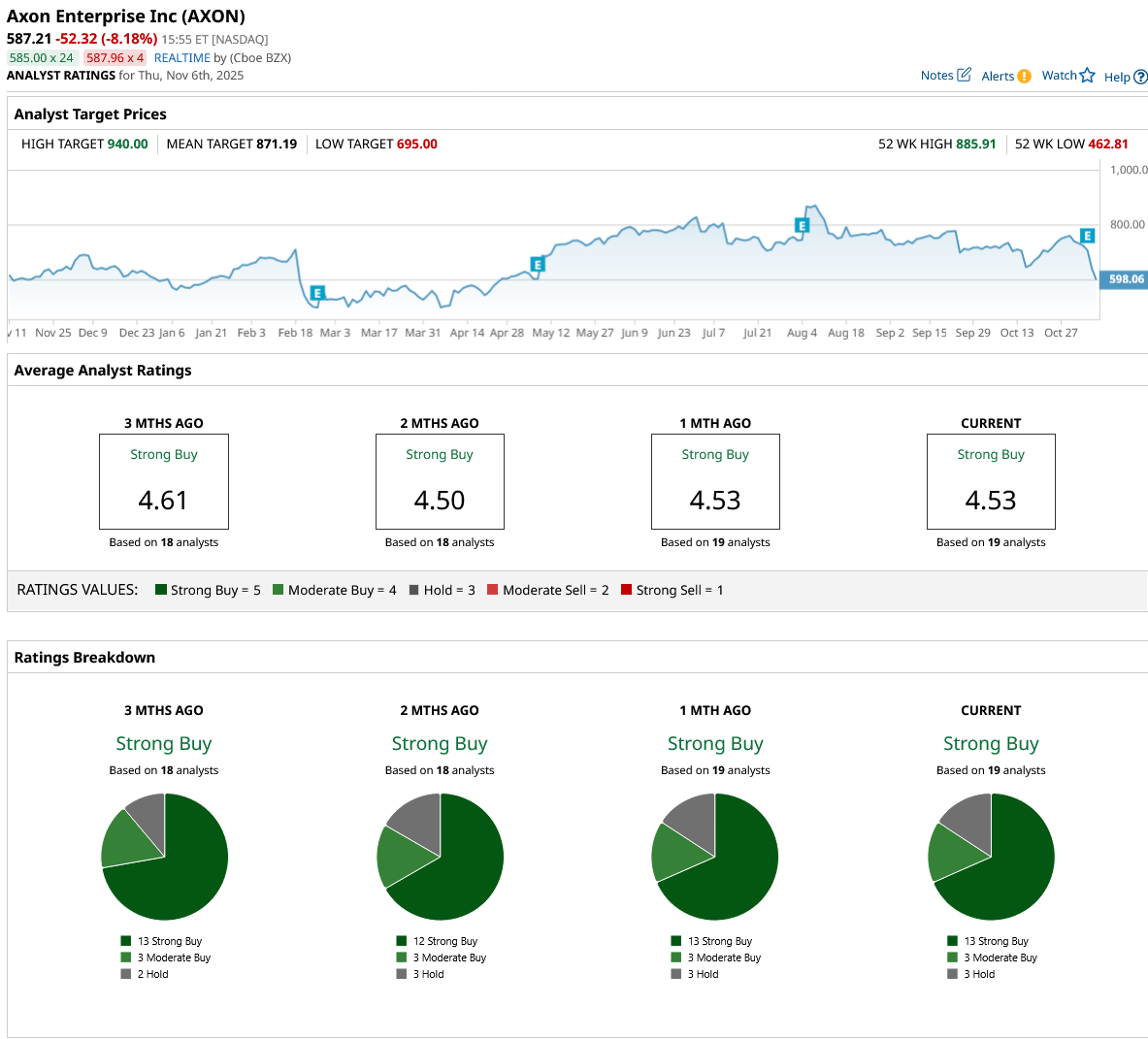

Out of the 19 analysts covering AXON stock, 13 recommend “Strong Buy,” three recommend “Moderate Buy,” and three recommend “Hold.” The average AXON stock price target is $871.19, above the current price of $587.21.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ServiceNow Just Announced a 5-for-1 Stock Split. So, Is Now the Time to Buy NOW Stock?

- Palantir Is Getting a Bigger Seat at the Defense Table. Does That Make PLTR Stock a Buy Here?

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?

- A $5.5 Billion Reason to Buy Cipher Mining Stock Here