Cleveland, Ohio-based TransDigm Group Incorporated (TDG) designs, produces, and supplies aircraft components. Valued at a market cap of $75.2 billion, the company focuses on proprietary, aerospace-grade parts with strong aftermarket demand, including actuators, ignition systems, pumps, valves, and engineered latching and locking devices.

Shares of this aerospace and defense company have underperformed the broader market over the past 52 weeks. TDG has gained 6% over this time frame, while the broader S&P 500 Index ($SPX) has soared 11%. Moreover, on a YTD basis, the stock is up 5.4%, compared to SPX’s 14% return.

Narrowing the focus, TDG’s underperformance looks even more pronounced when compared to the SPDR S&P Aerospace & Defense ETF (XAR), which has surged 29.6% over the past 52 weeks and 34.9% on a YTD basis.

On Nov. 12, shares of TDG gained 1.1% after its stronger-than-expected Q4 earnings release. The company’s net sales increased 11.5% year-over-year to $2.4 billion, surpassing consensus estimates by 1.2%. Moreover, its adjusted EPS of $10.82 improved 10.1% from the year-ago quarter and came in 5.6% ahead of analyst expectations. Strong organic sales growth, along with notable margin expansions, supported its upbeat performance.

For fiscal 2026, ending in September, analysts expect TDG’s EPS to grow marginally year over year to $35.90. The company’s earnings surprise history is mixed. It exceeded the consensus estimates in three of the last four quarters, while missing on another occasion.

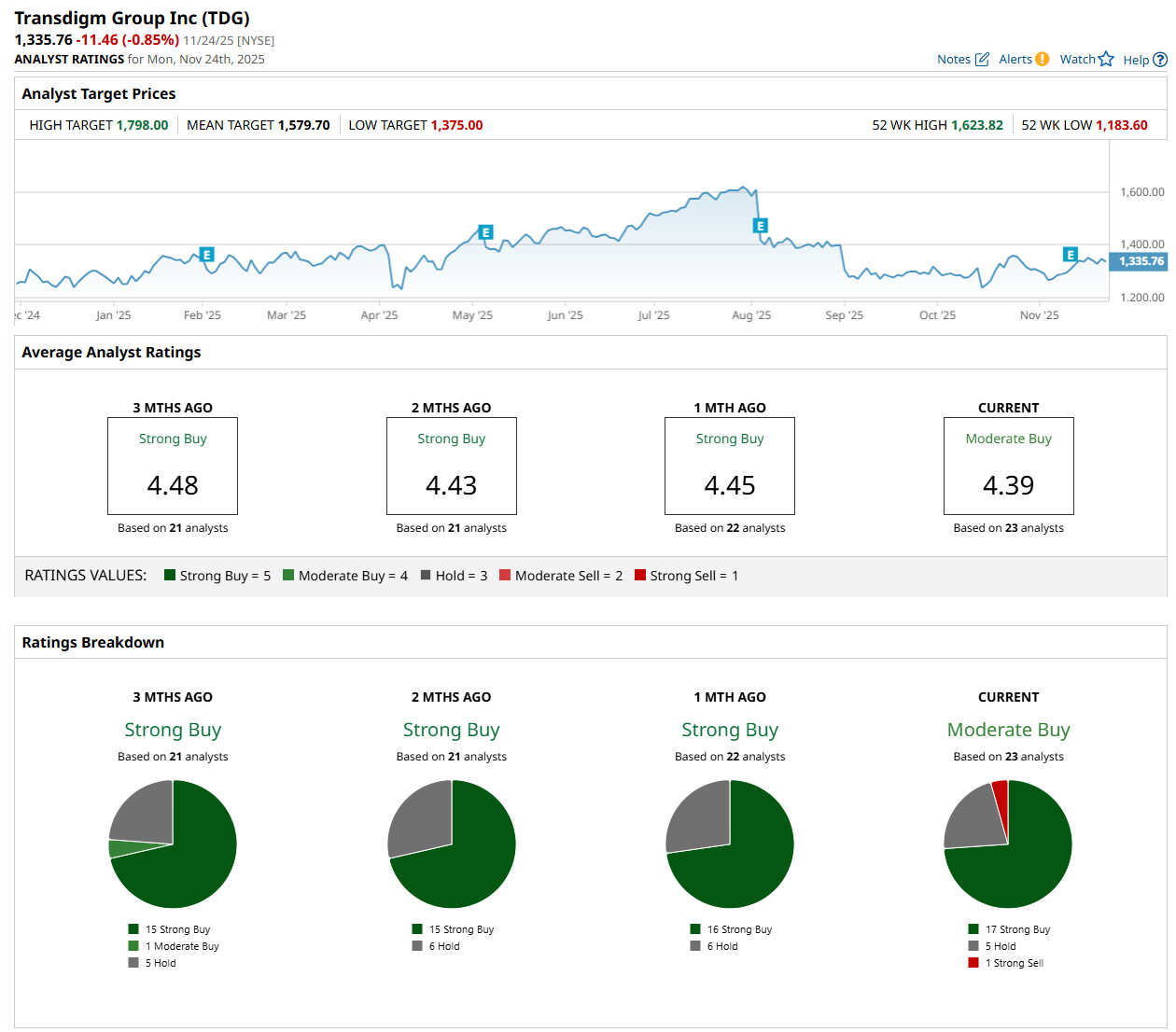

Among the 23 analysts covering the stock, the consensus rating is a "Moderate Buy,” which is based on 17 “Strong Buy,” five "Hold,” and one "Strong Sell” rating.

The configuration is less bullish than a month ago, with an overall "Strong Buy” rating, consisting of no analyst suggesting a “Strong Sell.”

On Nov. 18, BNP Paribas Exane initiated coverage of TDG with an “Outperform” rating and $1,775 price target, indicating a 32.9% potential upside from the current levels.

The mean price target of $1,579.70 represents an 18.3% premium from TDG’s current price levels, while the Street-high price target of $1,798 suggests a 34.6% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart