With a market cap of $23.2 billion, Teledyne Technologies Incorporated (TDY) is a diversified industrial and technology company known for its strong foothold in high-precision, high-performance engineering. Headquartered in California, it operates across digital imaging, instrumentation, aerospace and defense electronics, and engineered systems, serving customers that range from NASA and defense contractors to industrial manufacturers and scientific researchers.

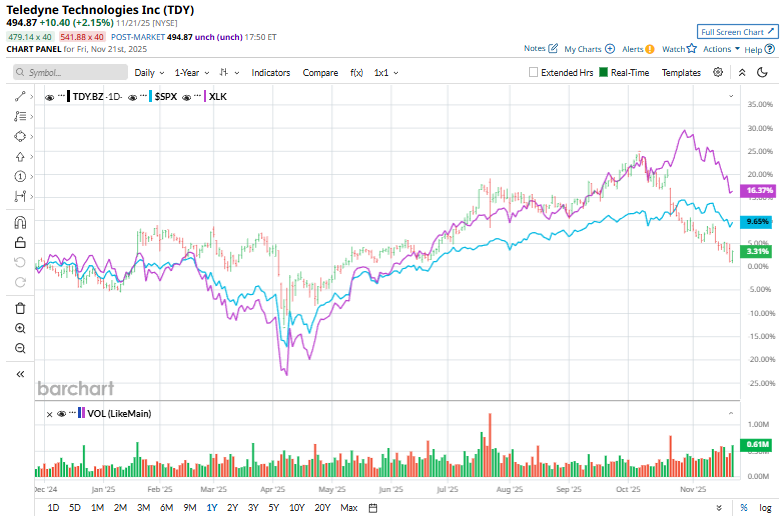

Teledyne’s stock has been moving, but not in step with the broader market’s rhythm. TDY stock has soared 3.1% over the past 52 weeks and has returned 6.6% on a YTD basis. In comparison, the S&P 500 Index ($SPX) has surged 11% over the past year and 12.3% in 2025.

The tech landscape hasn’t offered much relief either. The Technology Select Sector SPDR Fund (XLK) has gained 17% over the past year and 17.5% in 2025, leaving Teledyne trailing behind.

On Oct. 22, TDY shares slipped 5.2% after the company posted its third-quarter earnings, as investors reacted to a mixed performance. Net sales rose 6.7% year over year to $1.54 billion, showing steady topline growth, and the company delivered standout cash flow results, with record operating cash flow of $343.1 million and free cash flow of $313.9 million. However, EPS fell to $4.65 from $5.54 a year earlier, which weighed on investor sentiment.

For the current year ending in December, analysts expect Teledyne to post EPS of $21.52, a 9.1% year-over-year increase. Moreover, the company has a promising earnings surprise history. It beat the consensus earnings estimates in each of the past four quarters.

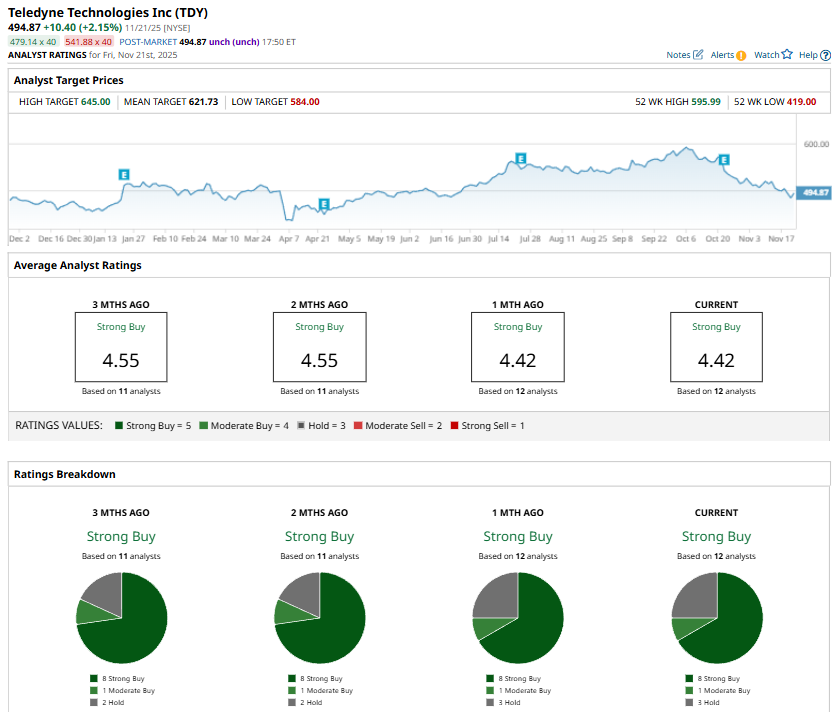

Among the 12 analysts covering the TDY stock, the consensus rating is a “Strong Buy.” That’s based on eight “Strong Buy,” one “Moderate Buy,” three one “Hold” rating.

On Oct. 16, Morgan Stanley’s Kristine Liwag reaffirmed her “Hold” rating on Teledyne Technologies and maintained a $620 price target.

TDY’s mean price target of $621.73 represents a premium of 25.4% from the current price levels. Its Street-high target of $645 implies an upswing potential of 30.3%.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart