Cisco (CSCO) has surged to a new 20-year high, briefly touching $79.50 on Nov. 13 after posting quarterly results that once again topped Wall Street’s expectations. Shares closed more than 4.6% higher as CSCO’s management raised full-year revenue and earnings outlook. Investor confidence has been further supported by the company’s steady expansion in recurring business, a key indicator of long-term stability.

Cisco reported total remaining performance obligations (RPO) of $42.9 billion, representing a 7% increase from the previous year. Product-related RPO was even stronger, rising 10%, with the long-term portion climbing 13% to $11.8 billion. Annualized recurring revenue (ARR) continues to trend higher as well, ending the quarter at $31.4 billion, up 5%, while product ARR expanded 7%.

Subscription revenue reached $8 billion, accounting for more than half of the company’s total revenue. Meanwhile, software revenue grew to $5.7 billion, representing a 3% increase.

Demand tied to artificial intelligence (AI) continues to lift demand for nearly every part of Cisco’s business. In its fiscal Q1 2026, revenue rose 8% from a year earlier, powered by a 10% jump in product sales. Product orders increased by 13%, indicating broad strength across regions and customer groups.

Networking remained the standout category, growing 15%, with especially strong performance in service provider routing, an area benefiting from AI infrastructure investments. Data center switching and enterprise routing also delivered double-digit gains, while Campus Switching posted healthy high-single-digit growth.

This solid demand trend will likely sustain in the quarter ahead. Cisco is benefiting from a structural shift as companies rush to expand their networks and data centers to support AI-driven workloads. At the same time, operational efficiencies continue to strengthen the company’s bottom line, creating a combination of growth and profitability that the market is likely to reward.

AI Infrastructure Boom Puts Cisco Back in the Spotlight

Cisco stock is stepping back into the market’s spotlight as the boom in AI infrastructure investment reshapes spending from enterprises and hyperscalers. The company is seeing a surge in networking product orders, with first-quarter growth landing in the high-teens, its fifth straight quarter of double-digit gains. That momentum is broad-based, spanning hyperscale data-center infrastructure, enterprise routing, campus switching, wireless systems, industrial IoT gear, and even servers.

A significant portion of this strength stems from enterprise customers upgrading their networks to support AI workloads. Within Cisco’s campus networking business, demand for switching, routing, and wireless equipment is running exceptionally high as organizations prepare for more AI-driven connectivity needs. The company’s newest products, from smart switches and secure routers to WiFi 7 wireless systems, are ramping faster than previous generations, a sign that a multi-year, multibillion-dollar refresh cycle is now underway.

Cisco’s industrial IoT segment is also delivering solid performance. Orders for ruggedized equipment increased by more than 25% year-over-year in the first quarter, driven by trends such as U.S. manufacturing onshoring, rising AI workloads at the network edge, and the early stages of physical AI adoption.

On the hyperscaler front, Cisco booked $1.3 billion in AI infrastructure orders during the quarter, split evenly between Silicon One systems and high-performance optics. This represents a sharp acceleration and solidifies Cisco’s relevance in advanced AI architectures. The company expects to recognize roughly $3 billion in AI-infrastructure revenue from hyperscalers in fiscal 2026. Demand is also strengthening for Cisco’s Acacia coherent pluggable optics, which offer attractive power and cost advantages as cloud providers extend AI clusters across their networks.

Importantly, AI-related spending is no longer limited to hyperscaler training clusters. Cisco is also seeing double-digit growth in data-center switching and compute orders as customers start preparing for inference workloads and emerging agentic applications. The company now has a pipeline exceeding $2 billion for high-performance networking products across sovereign cloud providers, neocloud platforms, and large enterprises.

With a solid networking portfolio led by Silicon One, AI-native security offerings, and a growing ecosystem of strategic partners, Cisco appears well-positioned to capture AI-driven infrastructure demand. The company’s accelerating order trends and deepening role in AI networking suggest that Cisco’s growth story is far from over.

Will CSCO Stock Climb Higher?

With accelerating demand across networking, data-center infrastructure, and recurring software and subscription businesses, Cisco is benefiting from a multi-year technology upgrade cycle. Its expanding RPO, strengthening ARR, and rising AI-driven orders point to solid growth ahead.

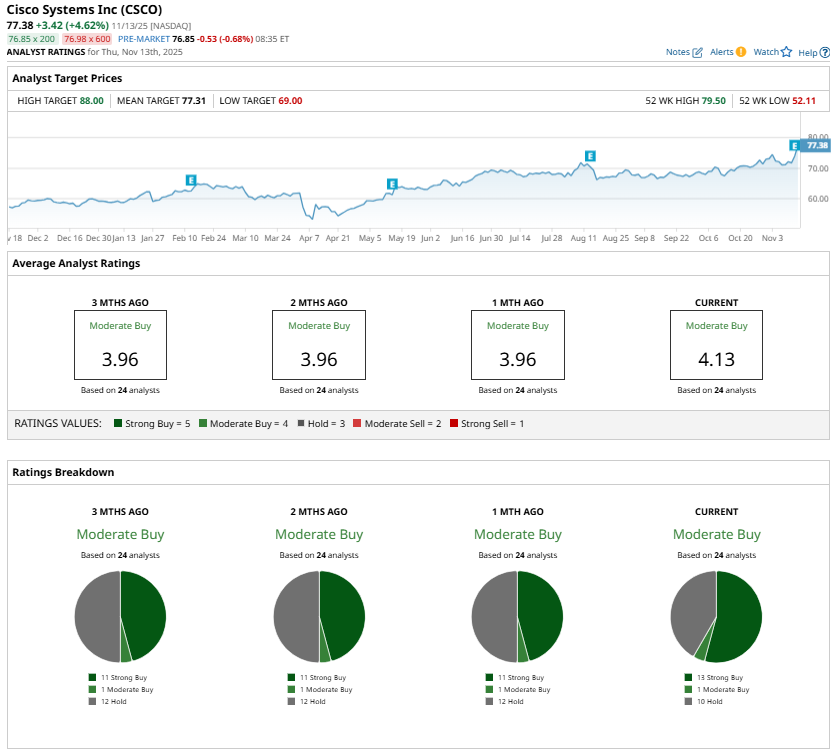

While Wall Street analysts maintain a “Moderate Buy” consensus rating on the stock, Cisco’s strategic position in the build-out of next-generation AI infrastructure gives the company a long runway for growth, indicating that its stock could climb higher.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- Legendary Investor Michael Burry Warns That Cloud Growth Is Slowing Despite AI Boom. Is This a Bubble?

- Stop Panicking and Look at the Charts: What Barchart’s Technical Indicators Are Telling Us Now

- JPMorgan Just Double-Upgraded Circle Stock. Should You Buy the Stablecoin Issuer’s Shares Here?

- Cisco Sets a New 20-Year High. Will CSCO Stock Climb Even Higher?