SSB Bancorp, Inc. Reports Unaudited Consolidated Financial Results For the year ended December 31, 2023

PITTSBURGH, PA / ACCESSWIRE / February 5, 2024 / SSB Bancorp, Inc. (OTC PINK:SSBP - news) (the "Company"), the holding company for SSB Bank (the "Bank"), today announced the Company's unaudited, consolidated results of operations for the year ended December 31, 2023.

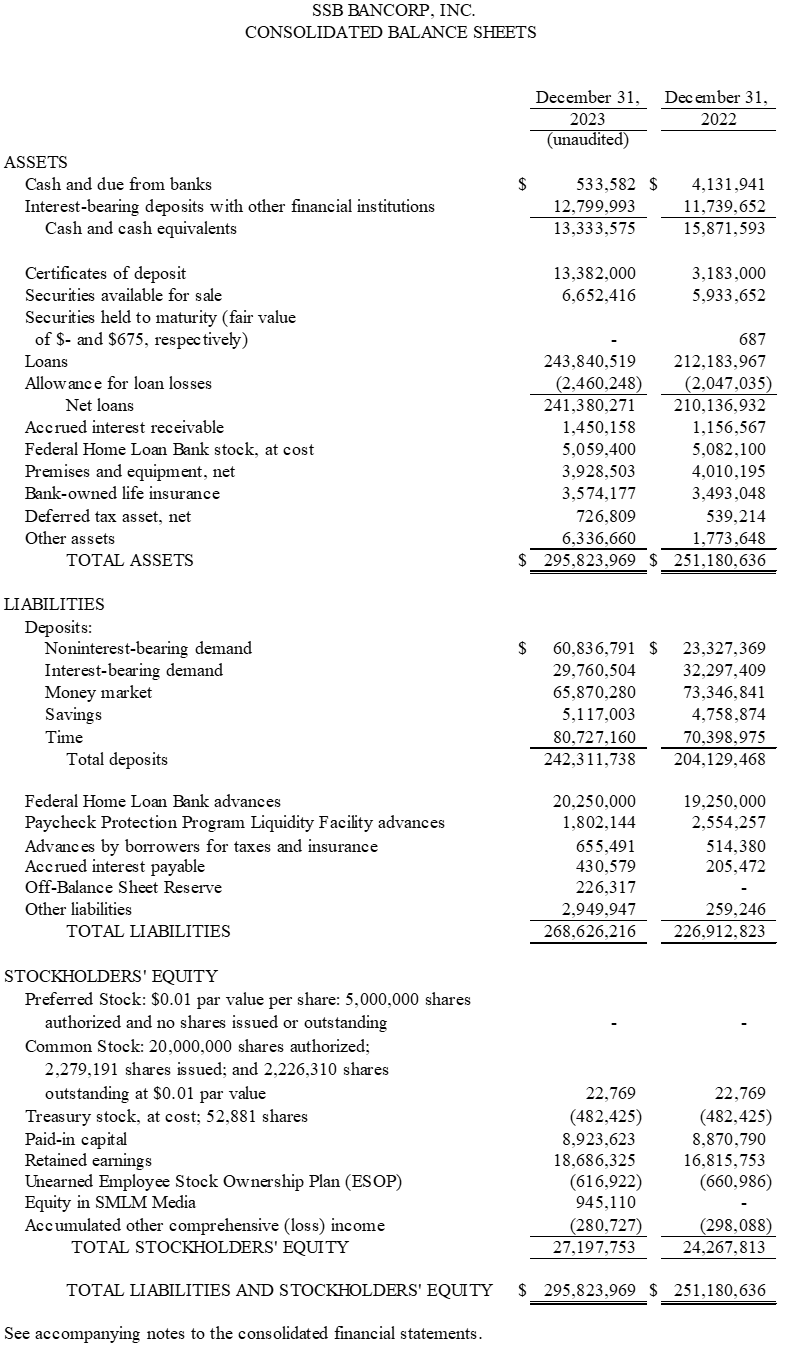

Total assets increased $44.6 million to $295.8 million at December 31, 2023, from $251.2 million at December 31, 2022. The increase in assets was due to an increase in deposits of $38.2 million as well as a net increase in Federal Home Loan Bank advances of $1.0 million. These funding increases were converted into a net increase of $31.2 million in net loans, $10.2 million in certificates of deposit, and $1.1 million in interest-bearing deposits with other financial institutions.

For the year ended December 31, 2023

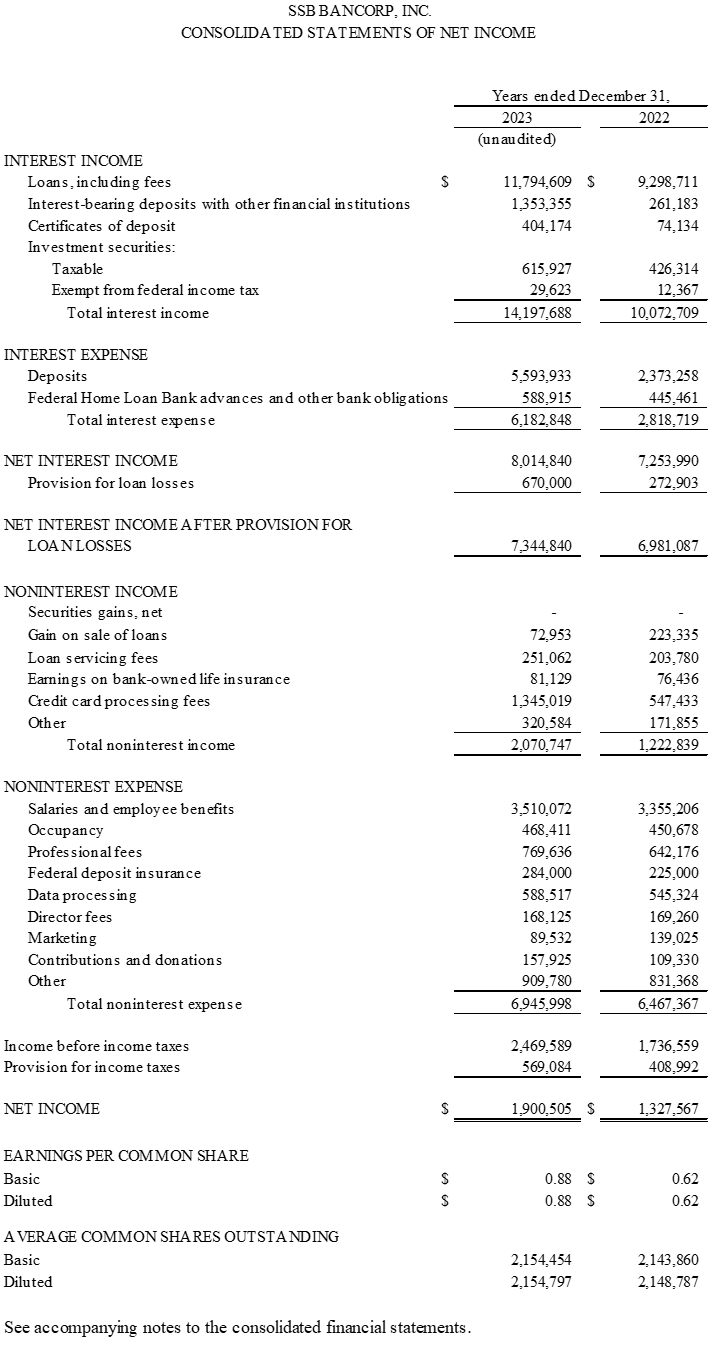

Net earnings for the year ended December 31, 2023, was $1.9 million, or $0.88 per basic and diluted share, compared to net earnings of $1.3 million, or $0.62 per basic and diluted share, for the year ended December 31, 2022.

Total interest and fee income increased by $4.1 million, or 41.0%, when comparing the results of the year ended December 31, 2023, to the year ended December 31, 2022. This is due to the increase in yield of interest-earning assets from 4.48% to 5.22% as well as an increase in average interest-earning assets of $47.3 million when comparing the two periods.

Interest expense increased by $3.4 million, or 119.4%, to $6.2 million in the year ended December 31, 2023, from $2.8 million in the year ended December 31, 2022. The increase in interest expense is due to the increase in cost of interest-bearing liabilities from 1.41% for the year ended December 31, 2022, to 2.99% for year ended December 31, 2023. This increase in cost is due to the increase in market interest rates when comparing the two periods. Additionally, average interest-bearing liabilities increased by $7.3 million from $199.2 million for the year ended December 31, 2022, to $206.5 million for the year ended December 31, 2023.

Noninterest income increased by $848,000, or 69.3%, to $2.1 million from $1.2 million when comparing the year ended December 31, 2023, to the year ended December 31, 2022. The increase is due to the increase in credit card processing fees of $798,000 when comparing the two periods. The credit card processing portfolio continues to grow in both the number of merchants as well as the volume of transactions settled.

Noninterest expense increased by $479,000 or 7.4% to $6.9 million. This was mainly due to increases in salaries and employee benefits of $155,000, outside professional fees of $127,000, and federal deposit insurance of $59,000, when comparing the two periods. These increases were offset by a decrease in marketing expense. The decrease in marketing fees reflects a change in business development methods with a higher emphasis on business development through referral of existing business channels.

This release may contain forward-looking statements within the meaning of the federal securities laws. These statements are not historical facts; rather, they are statements based on the Company's current expectations regarding its business strategies and their intended results and its future performance. Forward-looking statements are preceded by terms such as "expects", "believes", "anticipates", "intends" and similar expressions.

Forward-looking statements are not guarantees of future performance. Numerous risks and uncertainties could cause or contribute to the Company's actual results, performance and achievements to be materially different from those expected or implied by the forward-looking statements. Factors that may cause or contribute to these differences include, without limitation, general economic conditions, including changes in market interest rates and changes in monetary and fiscal policies of the federal government; legislative and regulatory changes.

Because of the risks and uncertainties inherent in forward-looking statements, readers are cautioned not to place undue reliance on them, whether included in this report or made elsewhere from time to time by the Company or on its behalf. The Company assumes no obligation to update any forward-looking statements.

SOURCE: SSB Bancorp, Inc.

View the original press release on accesswire.com