Revenue growth accelerates in Q3'24 with robust margins

CHICAGO, IL / ACCESSWIRE / October 31, 2024 / Kin, the direct-to-consumer home insurance company built for every new normal, today announced operating results for its third quarter ended September 30, 2024.

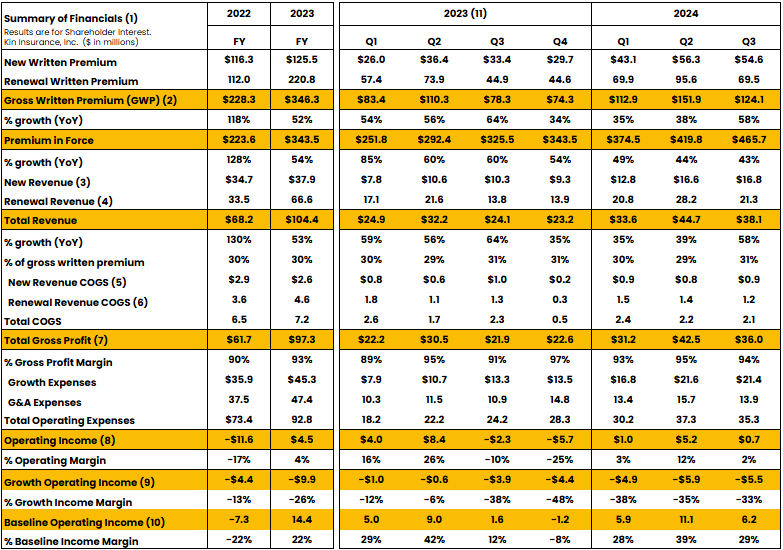

Kin recorded $38 million in total revenue during the third quarter of 2024, compared to $24.1 million in the prior year's third quarter. Kin's managed reciprocal exchanges generated $124 million in gross written premium in the third quarter of 2024, compared to $78.3 million in the third quarter of 2023. Kin's premium in force grew to $465.7 million.

"Q3 tends to be a slower growth quarter from a seasonal perspective, so we are pleased with a 58% year-over-year growth rate. We have also begun disclosing our gross profit margin, which was 94% in Q3. Our main ongoing costs to service an existing customer include customer service and claims overhead, as the costs of claims and reinsurance are borne by the reciprocal exchanges we manage," said Kin Founder and CEO Sean Harper. "As you can see, our gross margins are quite high, especially compared to traditional insurance agencies or distributors, who pay ongoing commissions to their producers."

Baseline Operating Margin, a metric the company began disclosing last quarter, was 29% in the third quarter, compared to 39% in the second quarter of 2024. "Our Baseline Operating Margin reflects the profitability Kin enjoys from fees based on the renewal premium recorded at our reciprocal exchanges, which are an increasing portion of our total premium and a driver of increasing profitability," said Kin CFO Jerry Fadden. "We are still investing heavily in our technology and competitive moat, which we don't include in growth expenses. The Baseline Operating Margin may be higher or lower in quarters with seasonal fluctuations in premium volume as our technology investment expenditures remain consistent across the year."

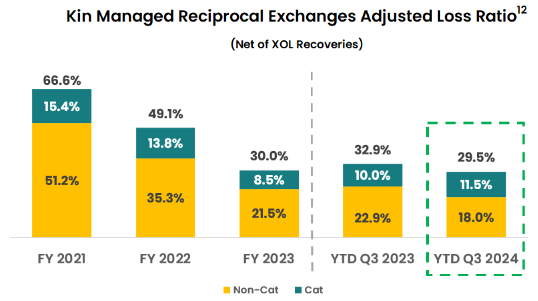

The adjusted loss ratio for the two reciprocal exchanges managed by Kin, net of catastrophe excess of loss (XOL) reinsurance recoveries, was 29.5% through the first three quarters of 202412. Non-cat adjusted loss ratio improved by 490 basis points over the same period last year, reflecting strong underwriting performance13. The cat-adjusted loss ratio increased by 150 basis points compared to the prior year due to more extreme weather events14.

"The third quarter is often the most active from an extreme weather perspective, and that was true this year with Hurricanes Beryl, Debby, Francine, and Helene. While the majority of hurricane risk is reinsured, the reciprocal exchanges are exposed to the retention loss, which increases the retained cat loss ratio. A roughly 30% retained loss ratio is in line with what we are targeting right now for the reciprocal exchanges and is an acceptable result," said Angel Conlin, Chief Insurance Officer at Kin. She continued, "Our proprietary claims technology really excelled at handling a large influx of claims efficiently and with a high level of customer satisfaction, which is nice to see because we have invested heavily in claims technology in the past two years."

Kin is now open for business in ten states with aggressive plans for continued market and product expansion in 2025. It also recently expanded its executive team by promoting Adam Sturt to Chief Analytics Officer in recognition of his contributions and the strategic importance of data analytics in building a sustainable competitive advantage for Kin. Adam has held increasing levels of responsibility across data, analytics, and underwriting over his 4 year tenure at Kin. Prior to joining Kin, he spent 10 years at Allstate Corporation. He is a credentialed actuary, holding the designation of Fellow of the Casualty Actuarial Society (FCAS) and holds a MS degree in Computer Science from the University of Chicago.

About Kin

Kin is the only pure-play, direct-to-consumer digital insurance provider focused on the growing homeowners insurance market. Kin makes homeowners insurance more convenient and affordable by eliminating the need for external agents. Kin's technology platform delivers a seamless user experience, customized options for coverage, and fast, high-quality claims service. Behind the scenes, Kin utilizes thousands of data points about each property to provide accurate pricing and produce better underwriting results. Kin serves customers as an agent and as the manager of two reciprocal exchanges, which are managed for the benefit of their customers. To learn more, visit www.kin.com.

Footnotes

The financial information represents the GAAP consolidated results of Kin Insurance, Inc. excluding its variable interest entities (VIEs), which are its reciprocal insurance carriers and captive.

Gross Written Premium includes premiums written by the two reciprocals managed by Kin Insurance, Inc. and certain third-party carriers.

New Revenue is a non-GAAP measure defined as fee revenue calculated in proportion to New Written Premium as a percentage of Total Written Premium at Kin's managed reciprocal exchanges.

Renewal Revenue is a non-GAAP measure defined as fee revenue calculated in proportion to Renewal Written Premium as a percentage of Total Written Premium at Kin's managed reciprocal exchanges.

New Revenue Cost of Good Sold (COGS) is a non-GAAP measure defined as the portion of customer servicing costs and internal claims labor expenses attributable to New Written Premium..

Renewal Revenue Cost of Good Sold (COGS) is a non-GAAP measure defined as the portion of customer service and internal claims labor expenses attributable to Renewal Written Premium .

Total Gross Profit is a non-GAAP measure defined as Total Revenue less customer servicing costs and internal claims labor expenses.

Operating Income is a non-GAAP measure defined as net income/loss attributable to Kin Insurance, Inc. excluding interest expense, income tax expense, depreciation, amortization, stock-based compensation and other non operating expenses.

Growth Operating Income is a non-GAAP measure defined as New Revenue minus New Revenue COGS and Growth Expenses; Growth Expenses include sales and marketing expenses, variable data costs and other expenses associated with customer acquisition.

Baseline Operating Income is a non-GAAP measure defined as Renewal Revenue minus Renewal Revenue COGS and G&A Expenses; G&A Expenses defined as operating expenses not associated with customer acquisition.

The company has updated 2023 Operating Income to reflect changes associated with the amortization of prepaid expenses identified as a part of the annual review of financial statements.

The adjusted loss ratio is a non-GAAP measure defined as loss and loss adjustment expenses, net of catastrophe excess of loss reinsurance recoverables divided by earned premium and the "earned" portion of subscriber surplus contributions during the period and excludes Claims Management fees to the reciprocal exhange's attorney-in-fact.

The non-cat adjusted loss ratio is a non-GAAP measure defined as total loss and loss adjustment expenses, excluding loss and loss adjustment expenses from named storms and Property Claim Services (PCS) events as defined by Insurance Services Office, Inc. (ISO) divided by earned premiums and the "earned" portion of subscriber surplus contributions during the period and excludes Claims Management fees to the reciprocal exchange's attorney-in-fact.

The cat adjusted loss ratio is a non-GAAP measure defined as total loss and loss adjustment expenses from named storms and PCS events, net of catastrophe excess of loss reinsurance recoverables, divided by earned premiums and the "earned" portion of subscriber surplus contributions during the period and excludes Claims Management fees to the reciprocal exchange's attorney-in-fact.

Media Contact:

Kelsey Glynn

press@kin.com

www.kin.com

SOURCE: Kin

View the original press release on accesswire.com